Back in March 2020, the BBC reported on the effect of coronavirus on global markets. The FTSE 100, the S&P 500, and the Dow all suffered their worst days in 30 years. A slow pandemic recovery

followed.

Now, as we head into summer 2022, what can the last 12 months tell us about the global economy’s coronavirus bounce-back and what do current global events mean for the 12 months ahead?

Keep reading to find out.

“Freedom Day” promised to kickstart the economy

Back in June 2021, the UK’s so-called “Freedom Day” was pushed back again, amid rising coronavirus cases. The signs were good, though, that normal service would soon be resumed as the FTSE 100 continued its slow recovery.

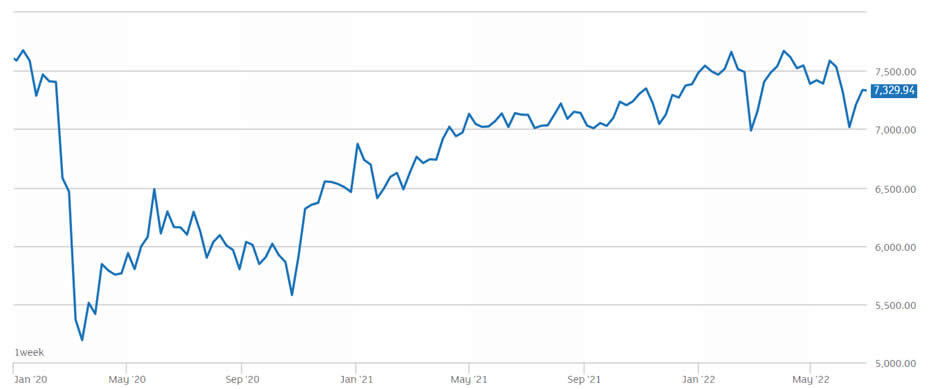

FTSE 100 January 2020 to June 2022

Source: London Stock Exchange

The World Bank was predicting the fastest growth rate in 80 years, forecasting that the global economy would grow by 5.6% in 2021.

By September, though, the Guardian was reporting the highest annual rise in UK inflation since records began, up from 2% in July to 3.2% for the 12 months to August. Rising food and energy prices, supply chain issues and labour shortages were all a factor.

Globally, America’s decision to continue with its planned evacuation of troops from Afghanistan, thereby ending the 20-year-long war, led to huge market uncertainty.

The World Bank revisits its growth forecasts

American markets enjoyed a so-called “Biden bounce” at the end of 2021 as election uncertainty subsided and Joe Biden was acknowledged as the 46th US president.

This capped off a faster than expected Covid recovery for the US, with manufacturing growing at its fastest pace in almost two years and unemployment down to 6.9% for October 2021, from 7.9% in September.

S&P 500 Index July 2019 to June 2022:

Source: MarketWatch

As 2022 dawned, continuing supply chain issues and the inflationary effects of world governments’ pumping huge sums into the market, all affected global economies.

China’s zero-covid stance meant protracted lockdowns for vast areas, while their continued tech company crackdown and the collapse of real estate company Evergrande continued to worry world markets.

All of which led to a downgrading of global economic growth forecasts.

As growth for advanced economies in 2021 was confirmed at 5.1%, the World Bank predicted global growth for 2022 of 4.1%.

By June 2022, this forecast was down to just 2.9%.

War in Ukraine hits global markets

The reasons for the decreased growth forecasts include the continuing influence of supply chain issues and rising prices. Plus, Russia’s February 2022 decision to invade Ukraine has had a major impact.

World Bank President David Malpass confirms: “The war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth. For many countries, a recession will be hard to avoid.”

Throughout 2022, UK inflation has continued to rise, hitting a 40-year high in the 12 months to May, at 9.1%.

The war in Ukraine is expected to contribute to a continued rise in energy and food prices. While the Bank of England (BoE) recently increased its base rate again, to 1.25%, it still predicts that UK inflation will peak at 11% around October 2022. Inflation isn’t expected to return to the BoE’s 2% target until 2024.

Markets over the next 12 months

It has been a tough start to the year for global markets, with coronavirus recoveries hampered by rising inflation and war in Ukraine.

World stock market returns 2010 to May 2022:

Source: JP Morgan (FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management) Notes: All indices are total returns in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 May 2022.

The MSCI All Country World Index is down by 21.7% for 2022, up to the end of May.

The S&P 500, as previously shown, has suffered since January. According to Bloomberg, it is already 20% from its January peak. This drop marks the worst half-year results for the index since 1970 and places it firmly in a bear market.

It isn’t alone.

With the Dow Jones and Nasdaq firmly in bear territory too, some experts predict that the US could see a recession by the second half of 2023.

The FTSE 100, meanwhile, is holding up well, dropping just 1.98% in the first six months of 2022.

Despite this, accountancy firm KPMG UK is reported in the Independent as predicting a fall in economic growth for the rest of 2022 and 2023. This “weakening domestic momentum” could put the UK at “significant risk of a mild recession” within the next 12 months, according to KPMG’s chief economist Yael Selfin.

Patience remains the key to your investments

With the war in Ukraine set to continue, global instability should be expected to hang around for some time yet, too.

While the cost of living crisis continues to bite in the UK, staying patient and ignoring the background noise is key to reaching your long-term investment goals.

At Credencis, we can help to ensure your investment portfolio matches your risk profile and provide regular reviews to ensure you are on track, rebalancing if necessary. This gives you peace of mind and confidence, whatever happens in the wider world.

Get in touch? We can help.

If you are worried about the current global economy or you have questions about the performance of your own investments, please get in touch. Email info@credencis.co.uk or call 01158 967 538.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.